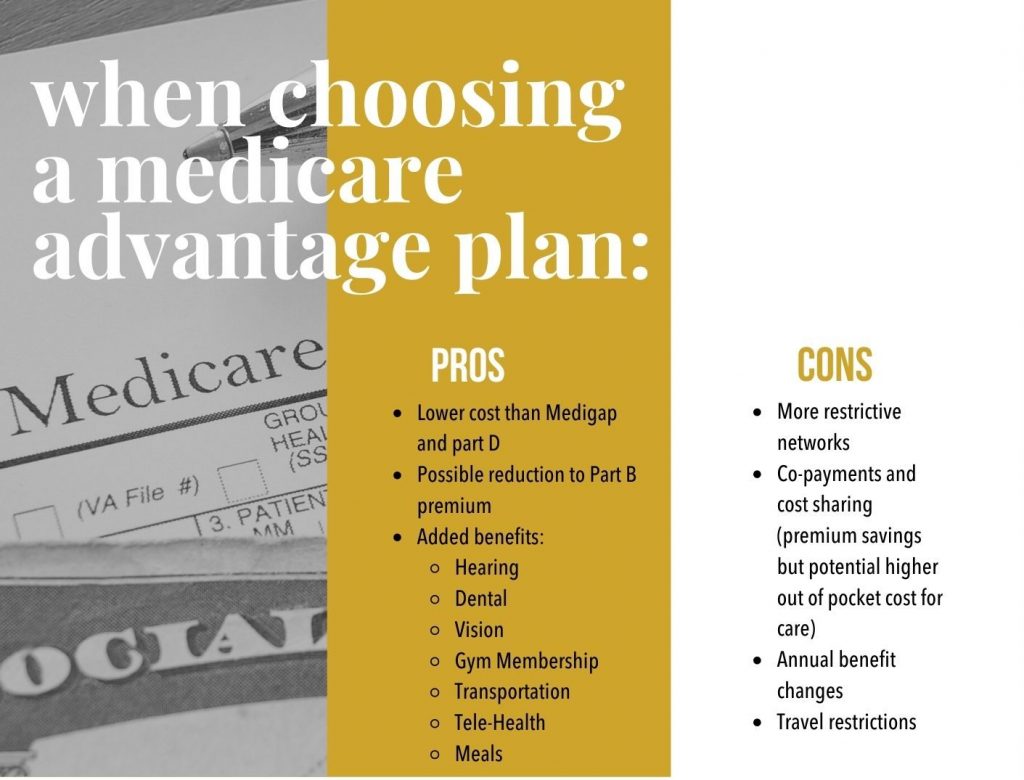

If you’ve watched television at all in the past 5 years, there is a good chance you’ve seen a commercial with Hall of Fame Quarterback Joe Namath touting the many benefits available to Medicare eligible beneficiaries through Medicare Advantage plans. “Get the benefits you deserve” we hear, “pay $0 for your benefits, get money back on your social security check, dental benefits, hearing, vision, gym memberships, telehealth visits, transportation and meals”— the list goes on and on. Many seniors are left wondering, “how can all this be true?” and “how do I get the benefits I’m entitled to?”

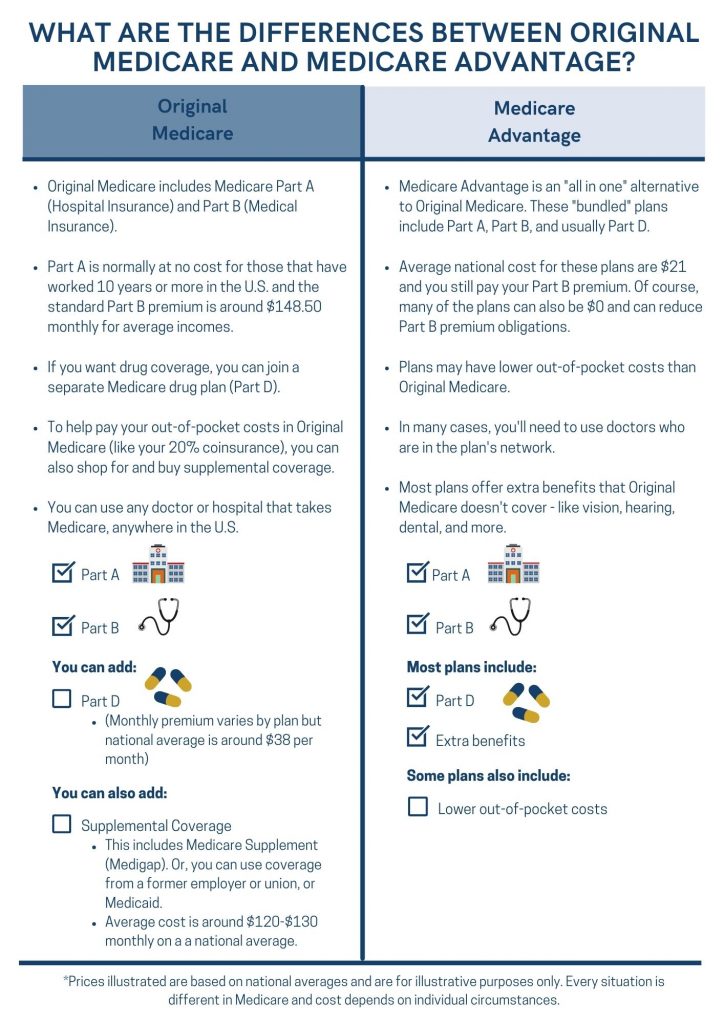

Many seniors asking these questions are also enrolling in these plans. For the past 15 years or more Medicare Advantage Plans have exploded in popularity. In 2021, nearly 42 percent of all Medicare eligible beneficiaries are enrolled in a Medicare Advantage, up from 32 percent just 5 years ago. With that number set to surpass 50 percent by 2030, there are still plenty of questions, mainly: is Medicare Advantage a viable and safe option for my clients?